Blossom into a Good Credit Score!

Blossom into a Good Credit Score!

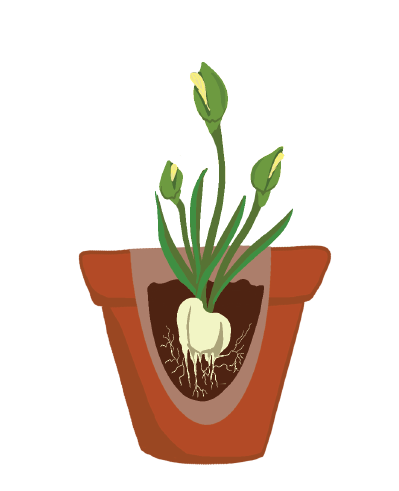

Your Credit Score needs patience and care just like a growing flower.

35% Payment History

Planting the Seeds

Plant your seeds during the right season. Be sure to pay your bills before their due date since this impacts your credit score the most. We suggest paying your bills 2 days early.

30% Amount Owed

Watering

Don’t overwater your seed or use up all of your available credit. Water it slowly and allow it to sit and grow as you pay down more than you spend.

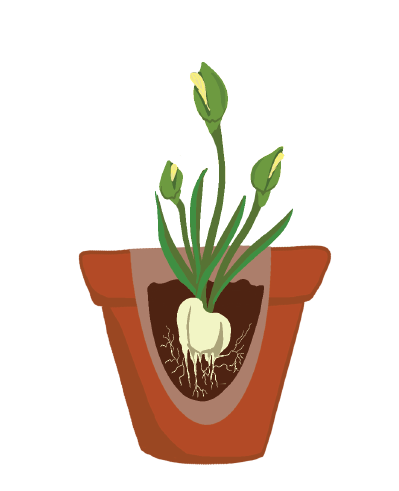

15% Length of History

Sprout

Be patient and give your seed some time to sprout. The longer your credit history, the more favorable to your score.

10% Credit Mix

Blossom

Blossom out to a few different bulbs for beautiful flowers to come. Likewise, FICO likes to see that you can balance a few different account types.

10% New Credit

Full Bloom

Now that you have beautifully bloomed flowers, it’s tempting to plant even more. But, be cautious. Opening a new card could negatively impact your credit score for one year.

35% Payment History

Planting the Seeds

Plant your seeds during the right season. Be sure to pay your bills before their due date since this impacts your credit score the most. We suggest paying your bills 2 days early.

30% Amount Owed

Watering

Don’t overwater your seed or use up all of your available credit. Water it slowly and allow it to sit and grow as you pay down more than you spend.

15% Length of History

Sprout

Be patient and give your seed some time to sprout. The longer your credit history, the more favorable to your score.

10% Credit Mix

Blossom

Blossom out to a few different bulbs for beautiful flowers to come. Likewise, FICO likes to see that you can balance a few different account types.

10% New Credit

Full Bloom

Now that you have beautifully bloomed flowers, it’s tempting to plant even more. But, be cautious. Opening a new card could negatively impact your credit score for one year.

The higher the credit score, the more money you’ll save!

Need help raising your credit score? Interested in refinancing or consolidating your debt? We may be able to help raise your credit score, lower your monthly payments & eliminate high-interest credit card debt!

Need to increase your score?

Becoming a homeowner?

Have credit card debt?

Is your credit score failing to blossom? Let’s get it to full bloom!

Credit Score Analysis

Please don't submit secure information.