Where is Your Money?

You’re likely not earning as much as you should. It could be somewhere better.

Discover a place where your money does more.

In a world where every penny counts, the question isn’t just about how much you have, but where you keep it. Is it just sitting somewhere, waiting for a purpose? Your money shouldn’t just be sitting; it should be earning instead.

Why your money should be with us.

- High Interest Rates on Deposits

- Certificate Specials Available

- Digital Banking

- No Junk Fees

- Educated Team

Featured Deposit Products

Your money could be somewhere better, like at NET Credit Union.

Certificate Specials

Earn More with NET Certificate Special!

13 months

4.50% APY!*

Annual Percentage Yield

25 months

4.25% APY!*

Annual Percentage Yield

Money Markets

Boost Your Savings with a Money Market!

Earn up to

4.50% APY!**

Annual Percentage Yield

Jumpstart your savings with a NET Credit Union money market account. It’s a great option when you’re looking for a safe investment with higher earnings than your share savings account. Our five-tiered rate of return allows you to earn a higher annual percentage yield on higher balances without locking in funds for a specific term.

Advanced Savers

Earn More with NET’s Advanced Savings Accounts!

0.75% APY!***

Annual Percentage Yield

Our Advanced Saver accounts come with our Digital Checking and Checking Plus accounts. These accounts earn more with higher interest rates across your accounts!

Earn up to 0.75% APY*** on the saving component and 6.00% APY*** on checking!

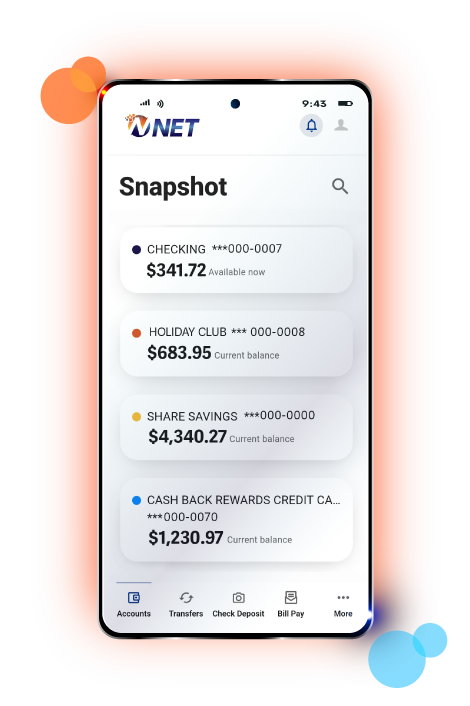

Digital Banking

Your account is available any time, anywhere when you have NET’s Digital Banking. Access your account with the app on your smartphone or mobile device.

Snapshot

View your account balances on the app without having to log in! This saves time when you’re in a rush to checkout.

Biometric Login

Log in to your account with your fingertips or face ID on your smartphone or compatible mobile device.

Remote Deposit

Transfer/Send

NET’s Digital Banking makes it easy to transfer funds among all of your accounts. You can even send money to another person instantly using Zelle!

Bill Pay

Account Information

Update your personal information in Digital Banking. Don’t waste time sitting on the phone or stopping by, simply do it digitally when it’s convenient for you.

Switching is Seamless

Worried about the hassle of moving your money? Don’t be. Our team can handle it for you.

Reach Us

Our headquarters are here in Scranton; but with our ATM network, digital banking and mobile app – we’re conveniently where you need us.

119 Mulberry Street

Scranton, PA 18503

570.961.5300

info@netcreditunion.com

Please don't send secure information

Leave A Message

*Please don't submit secure information.

*Annual Percentage Yield. Rates are for limited time only and are subject to change at any moment. $1,000 minimum to open certificate of deposit and earn APY, limited to $1,000,000 maximum per social security number. Subject to early withdrawal penalty. Fees may reduce earnings. We cannot accept orders via email. Must meet membership eligibility requirements. Federally insured by NCUA. Rate current as of 3/1/2024.

**Annual Percentage Yield. No minimum to open. Average daily balance of $500,000 to earn 4.50% APY. We cannot accept orders via email. Must meet membership eligibility requirements. Federally insured by NCUA. Rate current as of 3/1/2024.

***Annual Percentage Yield. Rate is earned based on balances of $1-$10,000 if qualifying criteria is met. 0.40% APY is earned on balances $10,000.01 or greater. A Digital Checking Account holder must meet the following qualifications in order to receive the benefits: An eligible NET Membership, Minimum of 15 debit card transactions posted each month (excluding ATM), must receive electronic statements and a minimum of $500 monthly deposited into the checking account. A Checking Plus Checking Account holder must meet the following qualifications in order to receive the benefits: An eligible NET Membership, a minimum of $500 monthly deposited into the checking account and an average $25,000 daily balance of shares/loans for the month. If qualifying criteria is not met, member will not earn an APY. Benefits & Rewards are only earned if qualifications are met on a monthly basis. If monthly qualifications have been met, payments will be received at the end of each month. Rate subject to change.